By Michaiah Varnes

A financial educator held a class on March 6 at Hood College’s Apple Resource Center to discuss the basics of taxes and low-cost resources for young adults.

About a half dozen students attended the presentation, which covered practical tax information and strategies for individuals new to filing taxes, as tax season had started the Sunday before the event.

The event was led by Dorthy Nuckols, a financial educator with the University of Maryland Extension.

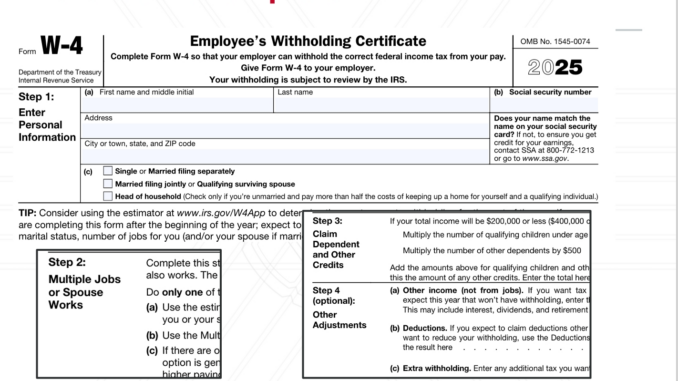

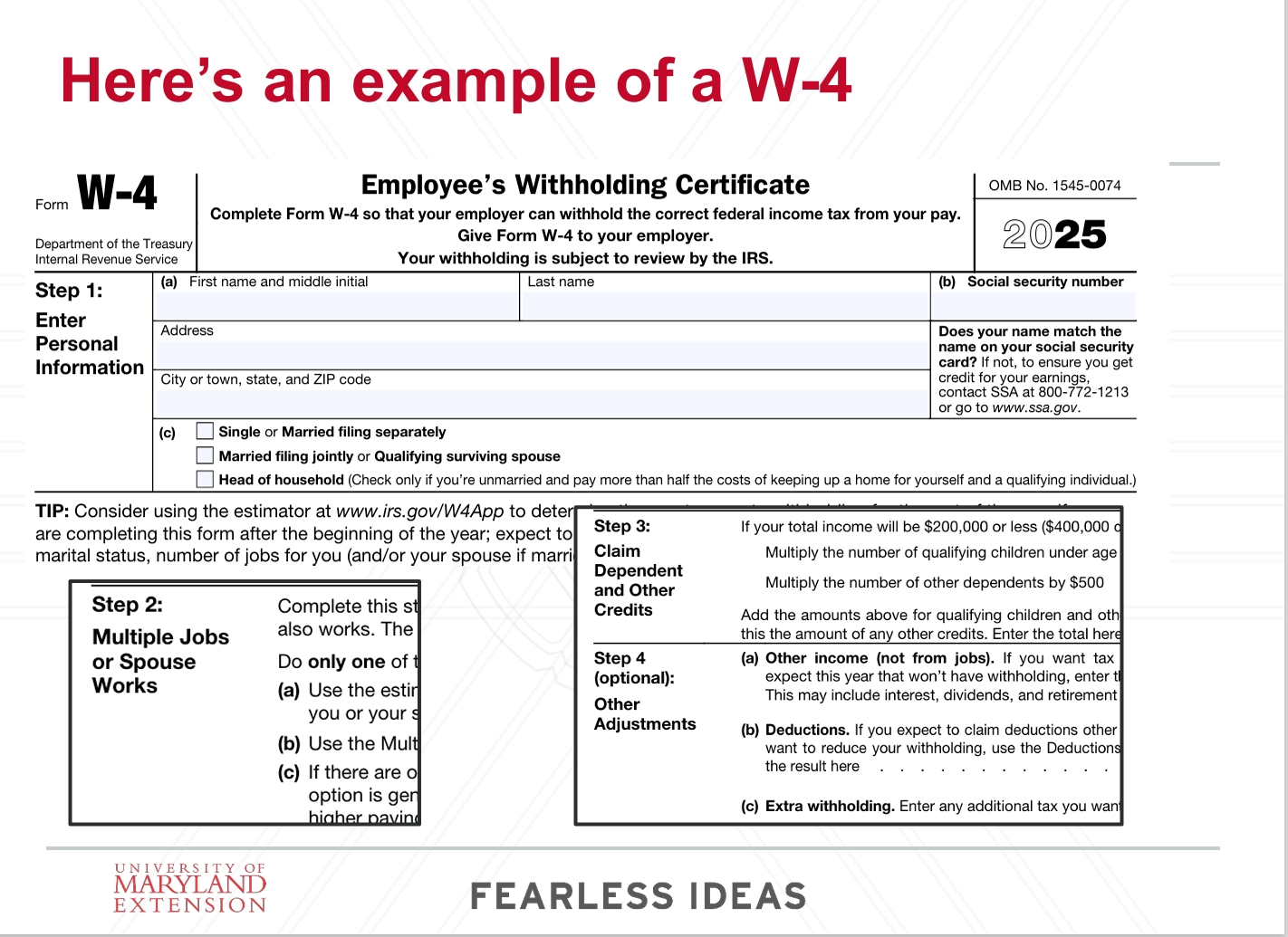

Nuckols emphasized the importance of W-4 forms and tax preparation, explaining how filing taxes varies based on individual circumstances. This includes dependents who are under 19 or under 24, full-time students or individuals with disabilities.

“Taxes are due April 15 each year for the previous year’s income. Extensions can be made for filing but not what’s fully due unless your taxes are complicated or a dependent,” Nuckols said.

The presentation included examples of essential tax forms and information on different taxpayer categories, including U.S. citizens, U.S. residents and green card holders.

Depending on their status, taxpayers may also pay sales tax, payroll tax, federal income tax, state income tax, property tax, and estate tax. The most common payments are federal and state income taxes.

Wes Martin, a Hood College sophomore, said, “[It’s] good to learn about taxes since I don’t know about this stuff.”

At the end of the presentation, students were encouraged to use VITA, a free tax preparation resource in Frederick.

More resources:

United Way Frederick – VITA Tax Prep

Guide to filing your taxes in 2024 | Consumer Financial Protection Bureau

Five ways to keep more of your tax refund | Consumer Financial Protection Bureau

How to File Taxes: A 2025 Tax Filing Guide – NerdWallet

Internal Revenue Service | An official website of the United States government

Be the first to comment