By Sofia Montoya-Deck //

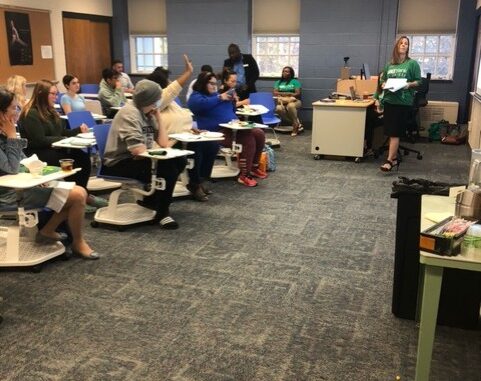

Students have been learning about budgeting, loans, interest rates and more in a series of financial literacy courses offered by the Hood College Wellness Office and George B Delaplaine Jr. School of Business in partnership with M&T Bank.

The four-session workshop began on Oct. 23 and runs until Nov. 13. M&T Bank staff lead each session, which has, so far, included the topics of budgeting, credit scores and reports, and investing. Each session also includes dinner for attendees provided by M&T Bank.

Twenty-three students registered for this semester’s financial series. “We’ve been very happy with the turnout and engagement during class sessions,” Director of Wellness Amanda Dymek said. “Students have asked thoughtful questions about budgeting & credit scores and this engagement indicates that these are important topics that are on the minds of college students.”

The Wellness Office typically offers financial literacy workshops in the spring semester in partnership with the University of Maryland Extension financial educators. Due to its rising popularity in the last three years, the Wellness Office decided to start offering classes in the fall semester as well.

According to Dymek, the financial classes typically begin with a review from the preceding week before delving into new content. “Depending on the topic, the class may be more lecture-based, discussion-based based or involve individual or group activities,” she said. “For example, in the first session, students worked through a workbook to create a budget, while the second class on credit scores was more lecture-based with lots of questions.”

M&T Bank managers from several local branches lead each session. Additionally, executives from M&T Bank, including Senior Vice President and Business Banking Regional Manager Andrew Kim and Senior Vice President and Retail have attended sessions to provide additional support and education to the class.

“Through these sessions, we hope students feel empowered to make informed decisions on their finances that will support their financial goals,” Dymek said. “Many people don’t have a formal education in personal finance and these classes provide an opportunity to learn the basics and set a foundation of knowledge and healthy behaviors that will impact you for the rest of your life.”

Sophomore Leigh Wear said the thing that has stuck with her most is the 50-30-20 method. “50% of your income should be your needs, 30% should be your wants and you should be saving 20% in order to have a healthy income and to have the money if you need it for emergencies,” she explained.

Senior Emily Preza shared that her main takeaway from the course is budgeting. “Budgeting is the big thing that I’ve learned, how important it is,” she said. “It keeps you organized. I think [the course] has been very helpful because I’ve learned new skills and tips with finances.”

Students interested in learning about financial literacy still have a chance to register on Pergola Connect for the last session on Nov. 13 where M&T Bank representatives will cover the topic of mortgages and home ownership.

After the completion of this semester’s series, feedback from students will be reviewed to make improvements for the next series of financial courses, which will be offered in the spring semester.

Be the first to comment